You’ve Tried Every ADHD Budgeting Trick!

The envelope system, the zero-based budget, the 50/30/20 rule, the color-coded app, the spreadsheet your financially savvy friend swears by. You’ve tried it all

Each one worked… for about two weeks.

By week three, you stopped logging purchases. By month two, you forgot the system even existed.

Now you’re staring at your bank account again, wondering, Where did all the money go this time?

Welcome to ADHD and money. You’re working with a brain that most traditional budgeting advice never considered.

The Hidden Executive Function Tax

Most budgeting advice quietly assumes one thing: that decision-making is easy.

But with ADHD, every money decision pulls from your executive function—the mental fuel that powers planning, organizing, remembering details, and hitting “pause” on impulses. When that fuel is limited, budgeting quickly becomes exhausting.

It sounds like this:

- Which category does this go in?

- How much is left for groceries?

- Did I already log that coffee?

- Should I move money around again?

Each tiny question is one more withdrawal from your executive function. By Tuesday afternoon, you’ve made so many micro money decisions that you’re mentally done, long before the week is.

Traditional budgeting systems are built for brains that experience decisions as background noise. When your brain processes decisions differently, those same systems don’t just fail; they drain the exact cognitive resources you need to function.

Why Standard Budget Categories Don’t Fit ADHD Brains

On paper, categories sound smart. Groceries here, dining out there, entertainment, transportation… neat little boxes for your spending.

In real life, especially for a non-linear ADHD mind, categories can backfire in three big ways:

- Decision paralysis at the checkout. That latte from the supermarket—is it “groceries” or “dining out”? A concert ticket—“entertainment” or “special event”? Suddenly, every purchase comes with a mini internal debate.

- Never‑ending mental math. You’re in Target, you see the throw pillows, and your brain starts spinning: How much is left in home decor? Did I already use that on frames last week? The real-time math burns energy you don’t have to spare.

- Pretty numbers that hide the real problem. “I spent $400 on food” doesn’t tell you anything useful. Was that planned grocery shopping that supports you, or last-minute takeout during an executive function crash? The category looks tidy, but it hides the pattern.

In other words: categories create more decision points. For ADHD budgeting, the goal isn’t more detail but rather fewer decisions. The architecture has to do the deciding for you.

What Money Blocks™ Does Differently

A lot of women with ADHD just assume they just haven’t found the right budgeting system yet. Maybe the perfect app, spreadsheet, or ADHD budgeting method is still out there.

But the real problem usually isn’t the app. It’s that most tools aren’t designed around ADHD, executive function, and how your brain actually makes decisions.

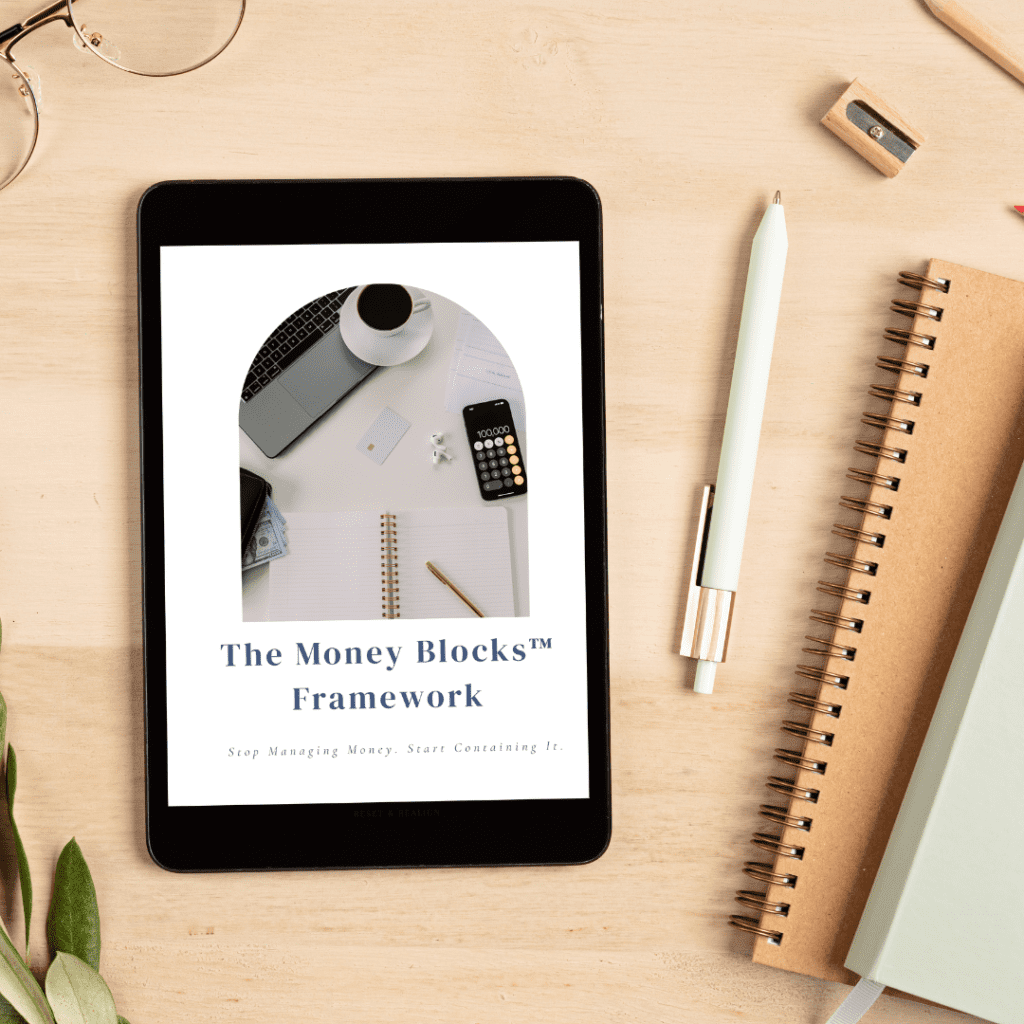

Money Blocks™ is a 5-step ADHD-friendly money framework that focuses on financial architecture instead of daily budgeting. It’s built to remove as many money decisions from your day as possible.

Here’s what that looks like:

- Automation first. You set things up so money moves automatically to essentials (bills, housing, non-negotiables), savings, and values-based spending before you even have a chance to impulse-spend. The system handles the transfers; you’re not manually juggling accounts.

- Decide once, benefit for months. Instead of agonizing over categories every day, you define clear guidelines up front: What counts as aligned spending? What always leads to regret? Once those decisions are baked into the structure, you just follow the path you already set.

- Quarterly check-ins, not daily tracking. You don’t need to track every coffee. Instead, you review and realign your Money Blocks™ every 90 days, in sync with your Permission to Achieve™ planning cycles. That rhythm matches how many ADHD brains prefer to work: shorter horizons, fewer but deeper reviews.

This is an ADHD budgeting system that doesn’t ask you to track. The I don’t like tracking, but I want to know where my money is going at all time. And this framework makes constant tracking unnecessary.

When Money Stops Draining Your Energy

Imagine opening your banking app and not feeling instantly anxious or ashamed. Your essentials and savings are already covered because your system took care of them before you even thought about it.

Imagine making a purchase and not immediately spiraling into, Should I really be spending this? Because you already decided: this is the kind of spending that aligns with your values and your goals.

Imagine having executive functions left over for your business, your career, your relationships, your creative work, or simply rest, because your finances aren’t consuming all your mental bandwidth by Tuesday afternoon.

That’s the shift when your money runs on a strong foundation instead of willpower.

The Real Question About ADHD and Budgeting

Budgeting with ADHD is because traditional budgeting tools demand constant executive function. And that happens to be your most limited resource.

So the real question isn’t:

How do I finally force myself to stick to a traditional budget?

The question is:

Am I ready to stop using money tools built for a different kind of brain, and start using financial architecture that’s actually built for mine?

Money Blocks™ lives inside the Permission to Achieve™ System because financial clarity isn’t a nice‑to‑have add‑on. It’s fundamental.

When your money system works with your ADHD brain, you free up the mental space you need to actually pursue what you want.

If you’re ready to stop fighting your brain around money, this framework might just be what’s missing.

The Permission to Achieve System

Permission to Achieve™ System is the structure that filters the noise, holds the weight, and restores focus without forcing urgency.