Have you ever been shocked by how little is left in your bank account? Yesterday there was a full paycheck’s worth; today the money is gone and you have no idea where it went. Even with your budgeting system can’t help prevent these surprises.

The late fee arrives before you even remember the bill existed.

You set a reminder, you see it, you think, “I’ll do it in an hour.” The hour passes. Three days pass. The bill is still unpaid.

Or worse: You pay it twice because you forgot you already paid it. Now you’re disputing charges and dealing with automated customer service hell.

What you’re experiencing is a mismatch between how your memory works and what traditional bill payment demands.

The Working Memory Problem with Bill Payment

So we talk about assumption here, and that’s because the way bill payments are set up is no different. Bill payment assumes you can neatly track dates, details, and follow-through in your head, like a mental filing system.

Receive bill → Note due date → Remember to pay before deadline → Execute payment

When you have ADHD, or beautifully complex minds, as I like to think of it, every step in this sequence is cognitively expensive

Receiving the bill requires noticing it arrived (attention), deciding to open it immediately vs. later (executive function), and storing the due date information (working memory).

Remembering to pay demands holding the task in working memory across days or weeks—despite dozens of other competing priorities.

Executing payment requires sustained attention to log in, navigate interfaces, enter information, and confirm—all when executive function might be at its lowest.

Even one weak link in this chain can lead to late fees and service interruptions, and to that familiar, heavy feeling of “why does this feel so hard when it seems easier for everyone else?

Why Reminders Don’t Actually Solve the Problem

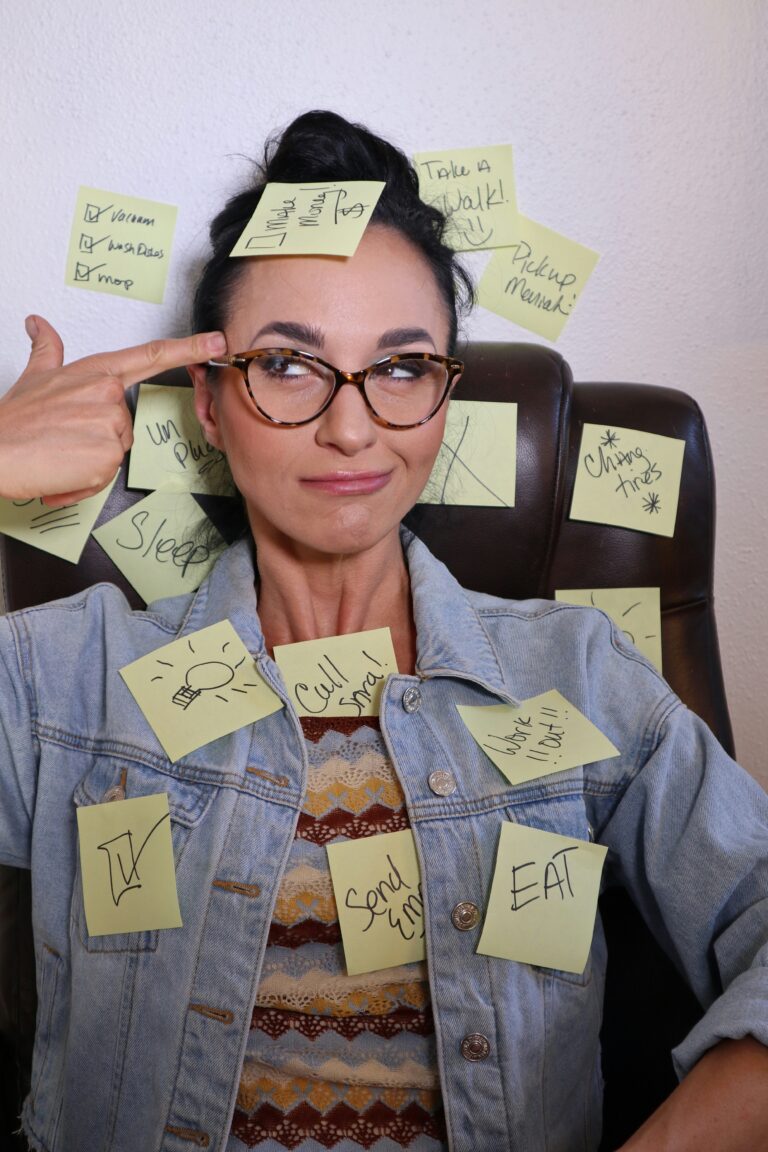

Open any productivity article and the go-to solution shows up fast: reminders, reminders, reminders. Calendar alerts. Phone notifications. Sticky notes on your fridge, mirror, monitor…you name it.

But for non-linear minds, reminders often create three new problems instead of solving the original one. And honestly, there was a time when the same quick-fix advice was all that was on offer, so it made sense that many of us repeated it before we knew better.

- Notification fatigue. When everything has a notification, nothing stands out. Your brain starts tuning them out completely.

- Timing mismatch. The reminder pops up while you’re in a meeting, driving, or deep in another task. You can’t act on it, so you tell yourself, “I’ll do it later,” and later quietly disappears.

- Executive function roulette. Even if the reminder lands at a good moment, paying the bill still takes executive energy right now. If your tank is empty, the reminder can’t carry you over the finish line.

Reminders aren’t a system. They’re just one more thing your brain has to keep up with.

What Time Blindness Has to Do with Late Payments

Time blindness makes bill payment exponentially harder.

You get a bill that’s due “in two weeks.” If you’re on your game, you write it down; if you’re more like me, you make a quick mental note and move on. Two weeks sounds like plenty of time…until suddenly it’s the day after the due date and you have no idea where those fourteen days went.

Or you plan to pay it “this weekend,” but the weekend stretches and shrinks unpredictably. Saturday feels like it just started, and then somehow it’s Monday and the bill is already overdue.

For minds that experience time differently, “remember to pay by the 15th” might as well be instructions in a foreign language.

The solution is to remove time from the equation as much as possible.

What Money Blocks™ Does Instead

Bill paying can start to feel like a science experiment in organization: change the tool, change the reminder, change the setup and waiting for the magic combo that finally sticks

Money Blocks™ is built for non-linear, time-blind, easily-overloaded brains. Instead of asking you to manage bills, it redesigns how your money moves so the bills manage themselves.

Money Blocks™ removes:

- Time blindness: You no longer have to remember dates; money moves automatically by category, not by how well you track the calendar.

- Executive function: “Paycheck day is the only decision point, and even that is mostly pre‑decided by your blocks.”

- Notification fatigue: There are fewer reminders because there are fewer actions required from you. The system runs, whether or not your brain is ‘on’ that day.

Discover Money Blocks™

Money Blocks™ turns “I hope I remembered” into “I know it’s handled,” by giving every dollar a clear job and quietly protecting your essentials in the background.

Integration with the Permission to Achieve™ System

Money Blocks™ works seamlessly with your quarterly planning cycle because it removes one of the biggest sources of background anxiety that drains executive function: “Did I pay that bill?”

When bill payment runs on a clear, ADHD‑friendly system, you reclaim cognitive space for what actually matters. Your planner can focus on meaningful goals instead of tracking due dates, and your habit‑anchor candle becomes a cue for calm planning and not a panic check for forgotten bills.

Money Blocks™ gives your money a simple structure that supports your planning rituals, so your financial system and your planning system reinforce each other instead of competing for your attention.

What Changes When Bills Handle Themselves

- Never get another late fee.

- Check your credit score and see it rise because payments go through on time, every time.

- Have zero mental bandwidth eaten up by “did I pay the electric bill?” thoughts.

That’s what Money Blocks™ is built to deliver. A financial structure that makes remembering optional instead of essential.

Reframing Forgotten Bills

Forgetting bills is your brain working exactly as it was designed, in a world where bill‑pay systems were built for a completely different design.

The question isn’t how to remember better.

So the question isn’t “How do I remember better?”

The question is: Are you ready to stop forcing your memory to do a job it wasn’t built for?

Can you see yourself using a financial structure that takes memory out of the equation?

Money Blocks™ is included inside the Permission to Achieve System because financial peace of mind is the base layer everything else rests on.

[Explore the Permission to Achieve System →]