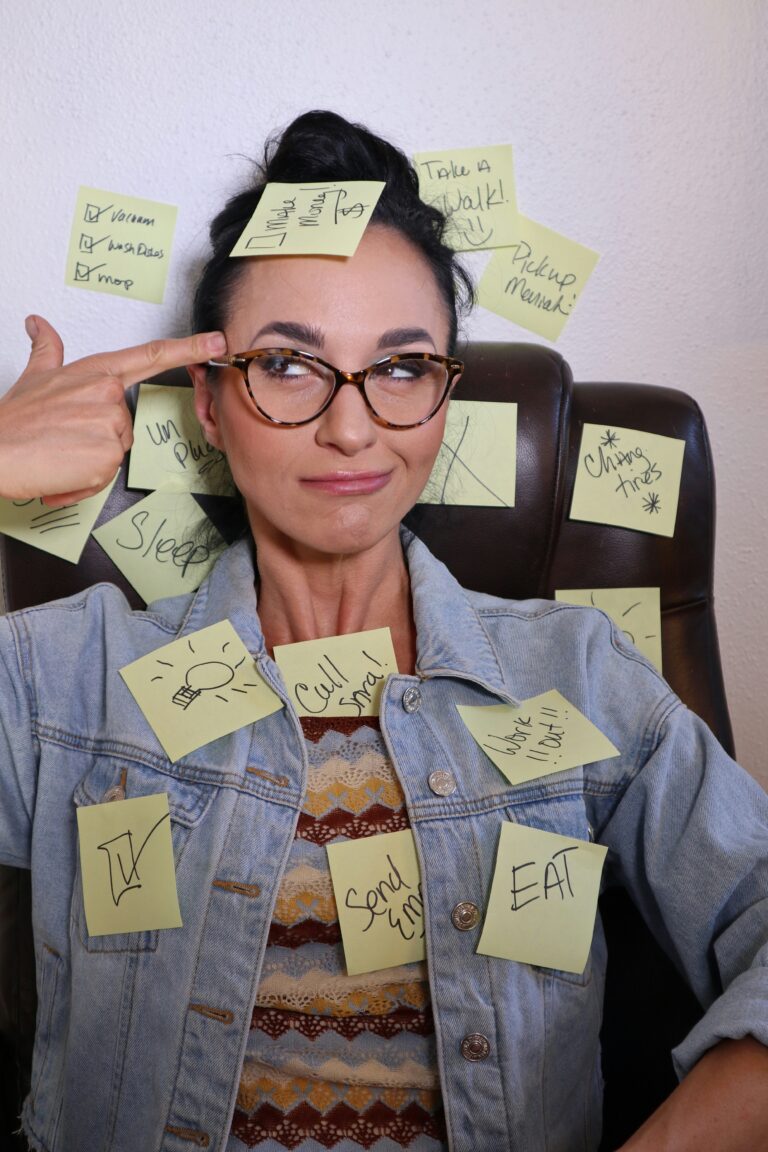

It’s 11 PM. You’ve been working all day. Your executive function is depleted.

You open Instagram. An ad appears. The product looks perfect. You click. You purchase. And you feel momentarily better. After all, Instagram “made” you buy it.

But by morning, the regret arrives. Why did I buy that? I don’t even need it.

This pattern repeats weekly. Sometimes daily. And every article about ADHD and money tells you the same useless advice: Just resist. Just pause. Just think it through.

If willpower worked, you wouldn’t be reading this.

The Dopamine Reality of Impulse Purchases

Impulse spending is dopamine-seeking behavior.

ADHD brains run on chronically low dopamine. When your executive function is depleted, which, for many, happens by mid‑afternoon, your brain actively scans for fast, reliable dopamine hits.

Shopping delivers: the novelty, the anticipation, the brief spike of “I got something new.”

Why “Pause Before Purchasing” Doesn’t Work

Every financial expert offers the same tired strategy: add items to your cart and wait 24 hours before buying.

On paper, it sounds reasonable: future‑you will be calm, rational, and detached enough to see that you do not “really” need the thing.

But if you have ADHD, that is rarely what happens.

When you want something, your brain does not forget—it goes to work.

Those 24 hours become research time. You read reviews, watch videos, compare versions, and build an airtight case for why this purchase is not only reasonable, but necessary.

The cart is not a cooling‑off period. It is an incubation chamber for justification.

By the time you come back, you are more attached, not less. You have invested thought, time, and emotion. Saying no now feels like wasting all that effort, and like denying yourself something your brain has already filed under “solution.”

For non‑linear minds, “just sleep on it” does not dissolve the desire—it gives it room to grow roots.

The problem is not that you lack discipline. The problem is that the strategy assumes a brain you do not have.

What Actually Works? Remove the Decision Point

You might have tried blocking shopping apps, deleting payment information, freezing credit cards. But all these do is create friction to “force” better decisions.

After too many yo‑yo budgets, you realized the real solution was removing the need to decide at all.

Money Blocks™ eliminates impulse spending by automating your financial priorities before dopamine-seeking can take over.

How it works:

You decide where your money goes before it has a chance to disappear. Your essentials are covered automatically and you savings stay protected.

What remains is truly discretionary, and because your financial foundation is already solid, you can spend it without guilt or the “should I really buy this?” spiral.

The framework removes the decision point entirely. You’re never standing at checkout (physical or digital) calculating whether this purchase will derail your month. The architecture has already decided.

When essentials are automated and values are clear, impulse purchases lose their power. You’re not resisting—you’re simply operating within a structure that already protects what matters most.

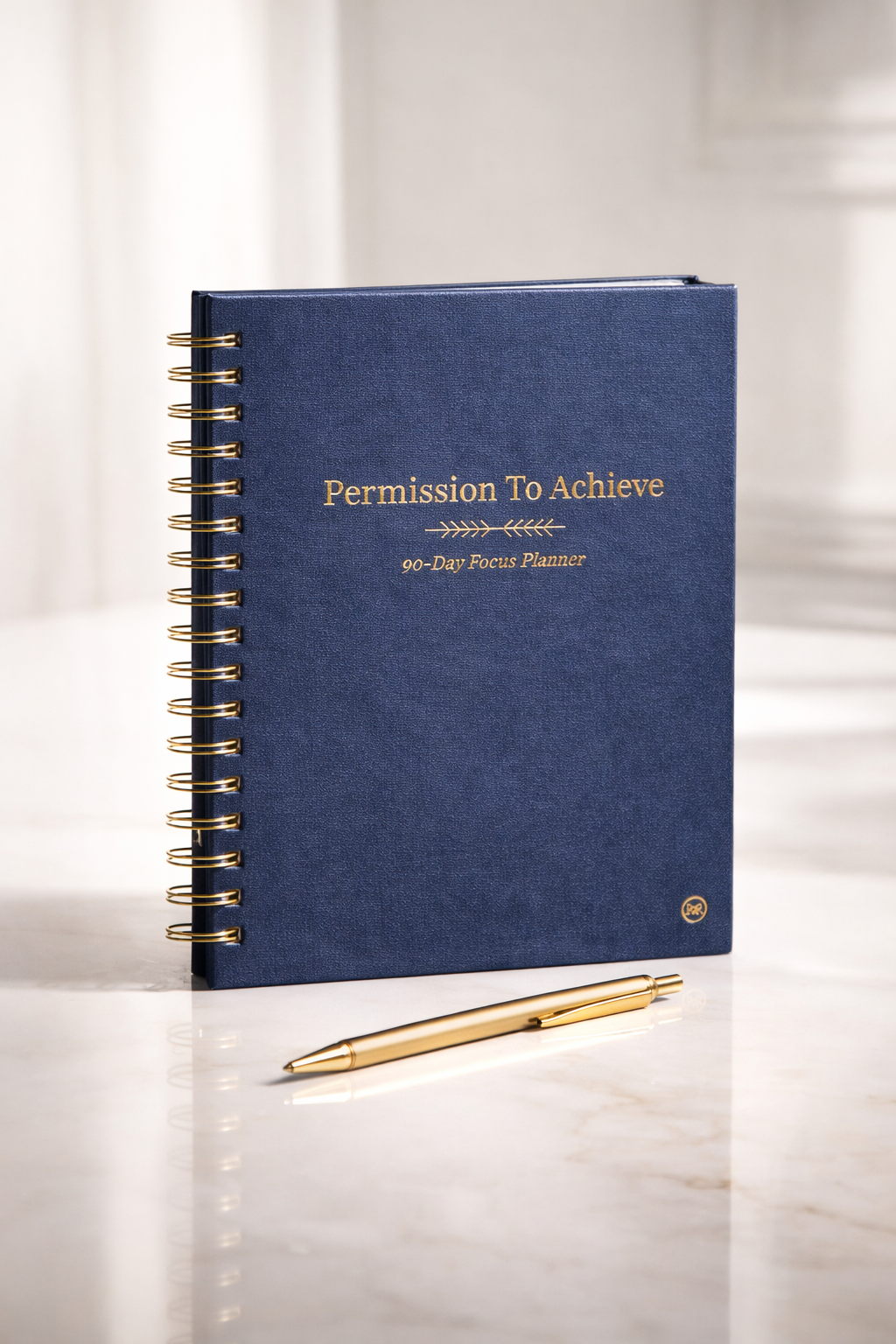

The Permission to Achieve System Integration

Integrated into the Permission to Achieve System™, the Money Blocks™ gives you financial clarity because impulse spending is usually triggered by two things:

- Executive function depletion from decision overload—which your quarterly planner addresses by reducing daily decisions

- Emotional dysregulation and dopamine-seeking—which your habit anchor candle helps regulate through sensory grounding

When planning architecture reduces decision fatigue, financial architecture can finally do its job. They are designed to work together, not in isolation.

Ready to stop impulse spending?

Money Blocks™ is not a standalone financial tool; it lives inside the Permission to Achieve™ System, where your time, decisions, and money are held by one coherent architecture.

What Changes When Impulse Spending Stops

Imagine opening shopping apps without automatically reaching for your credit card.

Or making purchases from genuine desire and not because of dopamine desperation.

Imagine checking your bank account without dread, knowing your financial priorities are already handled automatically.

This is what Money Blocks™ delivers. Not willpower. Not resistance. Architecture that works with your brain instead of demanding neurotypical impulse control.

The Real Question About Impulse Spending

With ADHD, impulse spending happens when an exhausted nervous system reaches for relief.It is what happens when executive function has clocked out but the world is still asking you to decide, choose, prioritize, and perform.

In that state, the “buy now” button is a tiny promise of ease, control, and a hit of “everything might feel better for a minute.” When executive function is depleted, your brain seeks dopamine.

The question isn’t how to develop better impulse control. The question is: Are you ready to stop fighting neurological reality, and start using financial architecture that removes the need for resistance?

That is why Money Blocks™ lives inside the Permission to Achieve System. Financial clarity is not a side quest; it is the foundation that lets every other goal—creative, professional, personal—actually move. When you seal the money leaks and handle essentials automatically, the same brain that used to spend from panic can finally spend from intention.

Are you ready to stop negotiating with impulse and start using a system that makes the right decision before the urge even shows up?

Ready to stop impulse spending?

Money Blocks™ is not a standalone financial tool; it lives inside the Permission to Achieve™ System, where your time, decisions, and money are held by one coherent architecture.

Discover Money Blocks™: Financial architecture that protects your priorities automatically.