The Money Blocks™ Framework

Money Clarity for Ambitious Women

Money Blocks™ is built for non-linear, time-blind, easily-overloaded brains.

Instead of asking you to manage bills, it redesigns how your money moves so the bills manage themselves.

In one afternoon, you will:

The real problem: money is stealing your focus

Budgets pile on more complexity, spreadsheets, and rules.

Money Blocks™ does the opposite: it strips things down and gives your brain four clear containers, so money decisions feel lighter instead of heavier.

Money Blocks™ is designed for women who recognize themselves in at least a few of these:

What is the Money Blocks™ Framework?

TELL ME MORE

Money Blocks™ is a no‑budget, money structure designed specifically for ADHD minds.

Standard budgets assume steady focus, low emotion around money, and a love of spreadsheets. ADHD brains rarely get that luxury

Money Blocks™ helps you:

- Reduce decision fatigue

- Create clear spending boundaries

- Remove guilt + uncertainty

- Turn money into a routine

What Makes Money Blocks™ Work

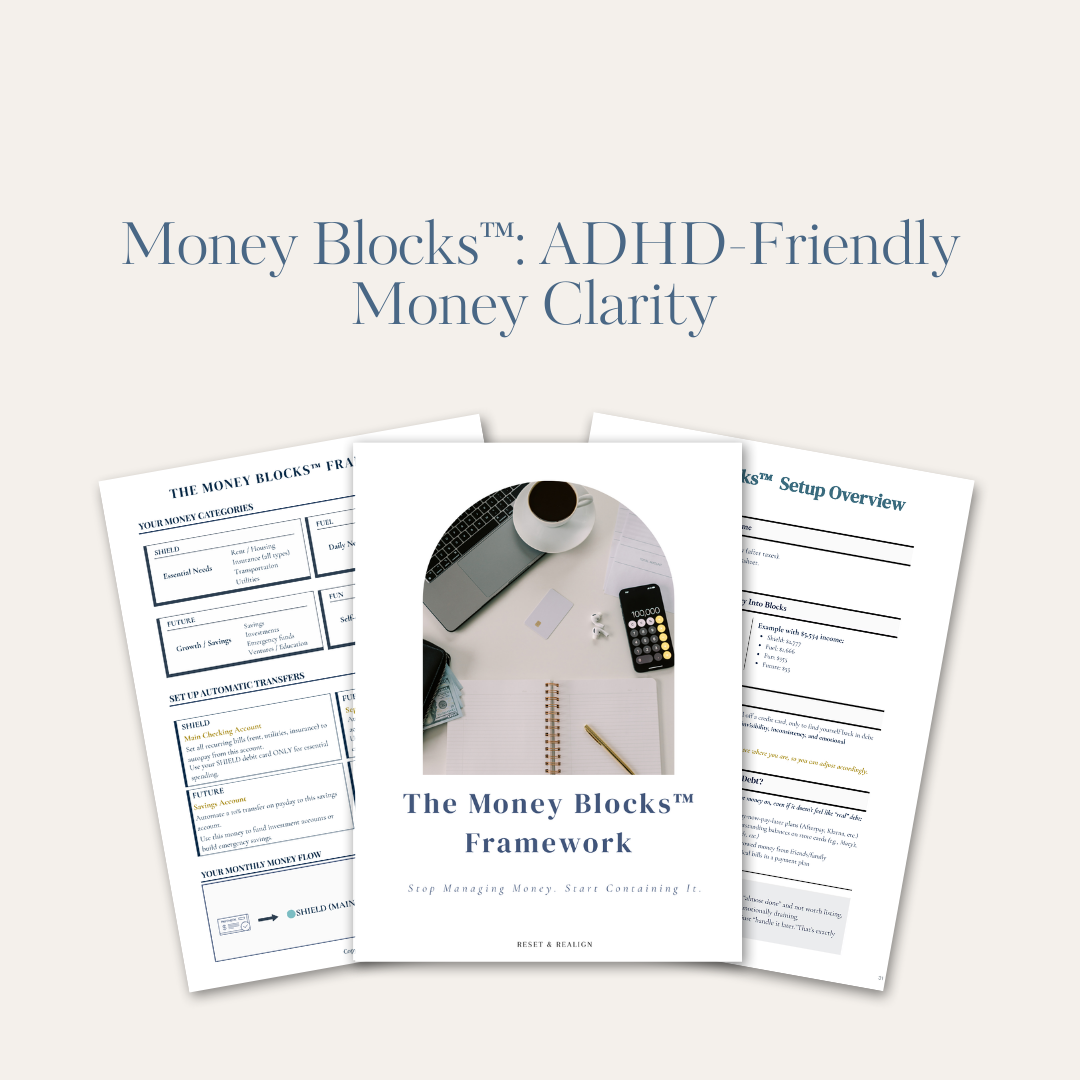

Instead of tracking every dollar, you place your money into four intentional “blocks” that reflect how your life truly works.

Nestled inside the Permission to Achieve™ System, Money Blocks™ protects what matters most first.

Once your money has a home, you can make decisions from clarity, not panic.

What’s Inside the Money Blocks™ Experience

When you purchase Money Blocks™, you get immediate access to:

Everything is delivered digitally, so you can start today and revisit whenever you need a reset.

How Your Money Blocks™ Fit Into the System:

Instant access: You’ll receive a download link and email access to your PDFs (and video, if included).

One focused setup session: Set aside some tine. Use the audit, workbook, and checklist to set up your four blocks and connect them to your real accounts.

Quarterly 15–20 minute resets: Every season, use the reset ritual to tweak percentages, adjust for life changes, and press “reset” without starting over.

By the end of day one, you will know:

- How much goes into Shield, Fuel, Future, and Fun.

- What’s safe to spend.

- What’s already protecting your future.